Summary

Shopify is a cloud-based (SaaS) platform that provides solutions to build an online shopping mall. Non-professionals can easily use, therefore from small businesses and major enterprises who want to have their online shopping websites are Shopify’s potential customers. With the huge market potential, it is worth keeping eyes on Shopify.

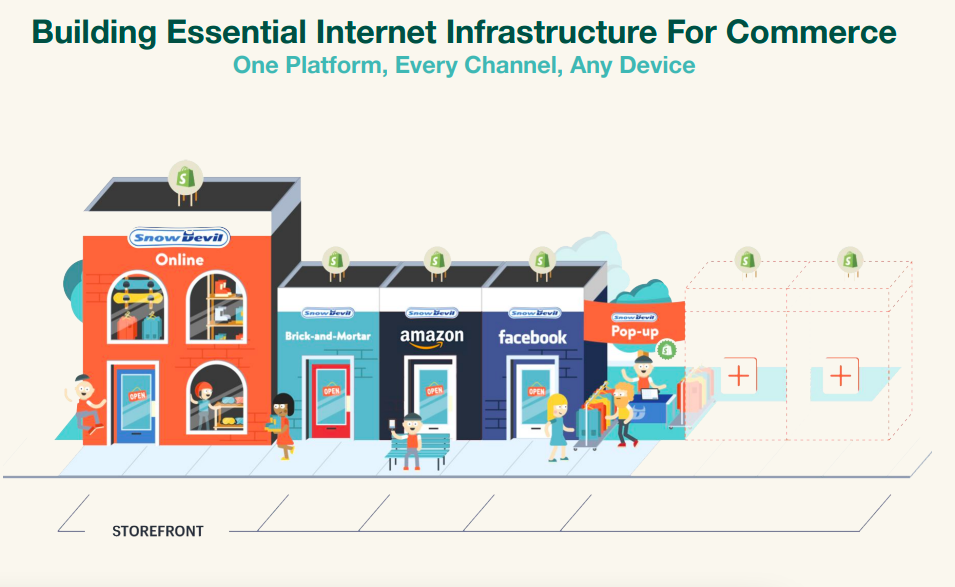

Merchants can manage their online shop easily even though they aren’t experts. The intuitive operation management method differentiates Shopify from other existing players. Merchant can use the services such as domain hosting, orders, stock management, delivery, payments, marketing, finance that are needed to build an online shop.

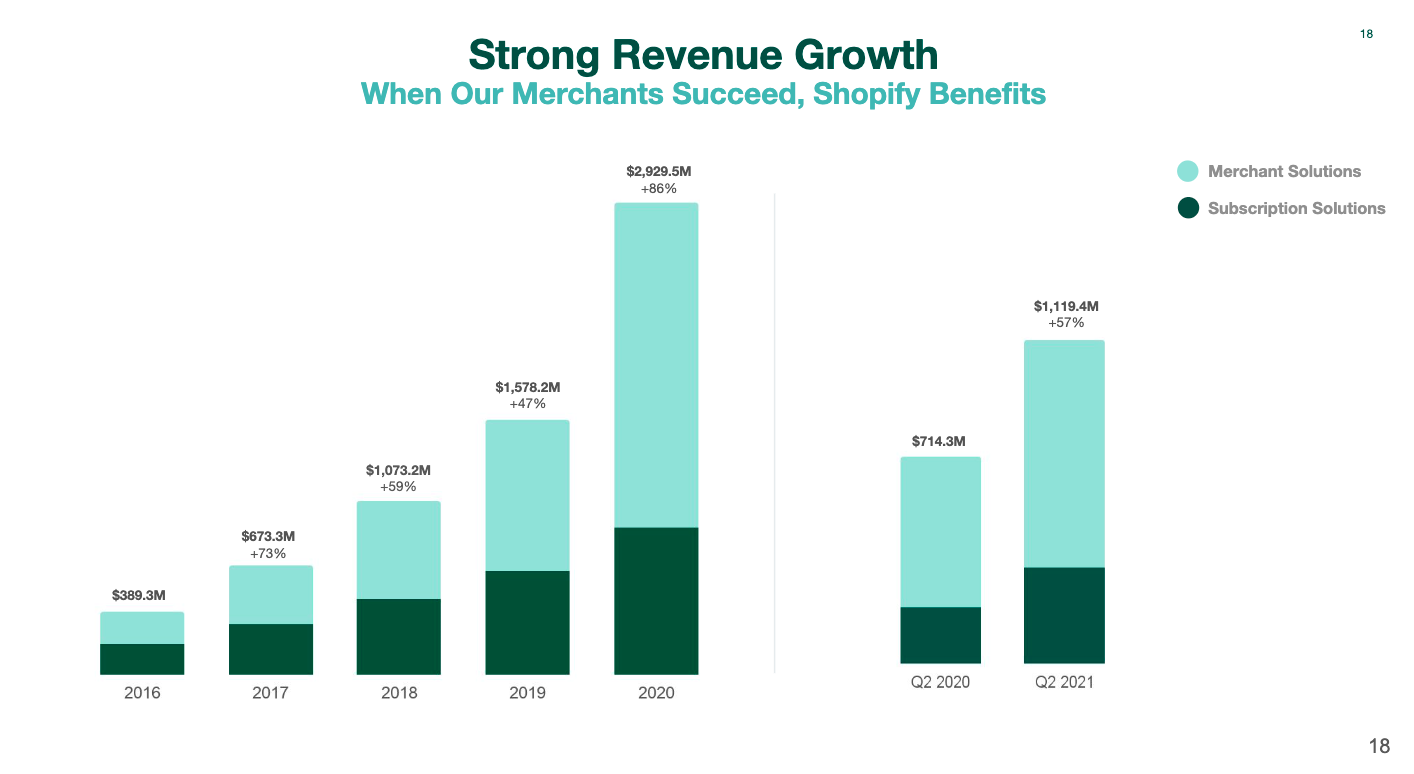

Lowering the entry barriers, the demand Shopify’s solution has started to increase exponentially. As a consequence, its revenue has grown from 20million dollars in 2012 to 1.58billions in 2019. Grew by 82.2% annually(CAGR).

The solution covers from small businesses to big enterprises.

There are 4 types of plans, basic, standard, advanced and Shopify plus. Each starts from $29/m, $79/m, $299/m and $<2000/m. Of course, expensive plans offer more features. The basic plan fits for small individual businesses, and Standard and Advanced plans fit for medium-sized companies. The major enterprises can choose the Shopify Plus plan which costs more than 2000 dollars per month.

As you can see, there are various types of customers. In the bigger picture, Shopify doesn’t just help merchants to make their shopping mall, it makes them grow to medium-sized or major businesses through Shopify. Therefore, the merchants and Shopify grow together.

Plans and Pricing: https://www.shopify.com/pricing

Profit Model

There are two profit models. Subscription Solutions and Merchant Solutions.

Subscription Solutions

Monthly Recurring Revenue - Core is a sum of subscription revenue from merchants(exclude Shopify plus)

Monthly Recurring Revenue - Shopify Plus is subscription revenues from major enterprises which use Shopify plus plan. The plan starts from $2000 monthly.

Additional Features Fee - Apps, Themes, Domains etc are additional revenue apart from Monthly Recurring Revenue.

Merchant Solutions

Shopify Payment - Takes the most proportion of merchant solution revenue. The basic fee is 30cents and an additional 2.4-2.9% of volume. When merchants use third-party payment services, apart from processing fees to third-party, they also need to pay a transaction fee of 0.5-2.0% to Shopify.

Shopify Capital - Provided in a few countries including the U.S. It is divided into two services, MCA(Marchant Cash Advance) and Loan.

Shopify Shipping - Let merchants buy shipping labels at a discounted price. Partnered with USPS, UPS, DHL, Canada Post and Sendle. Amount merchants paid minus Shopify’s cost of buying the label is recognized as revenue.

Shopify Fulfilment Network - Fulfilment Network Service is only available in the U.S. Shopify stores the products in their storage, and when the orders are made, Shopify does every shipping process instead of Merchants from packaging to Shipping. It seems as if of Amazon’s model.

Shopify POS - Revenue of sales of POS and Software utilized in offline stores.

Shop Pay - Shop Pay will become available to all merchants selling in the U.S. on Facebook and Google, even if they don't use Shopify's online store, positioning Shop Pay to become the preferred checkout for all merchants, whether they are on Shopify's platform or not.

Source: Shopify IR

The Numbers of Subscriptions and Merchant Solutions

For recent 4 years, Shopify recorded an average of 66.25% annual growth in Merchant and Subscription Solutions. Second-quarter, this year, grew more than 50% YOY.

Source: Shopify IR

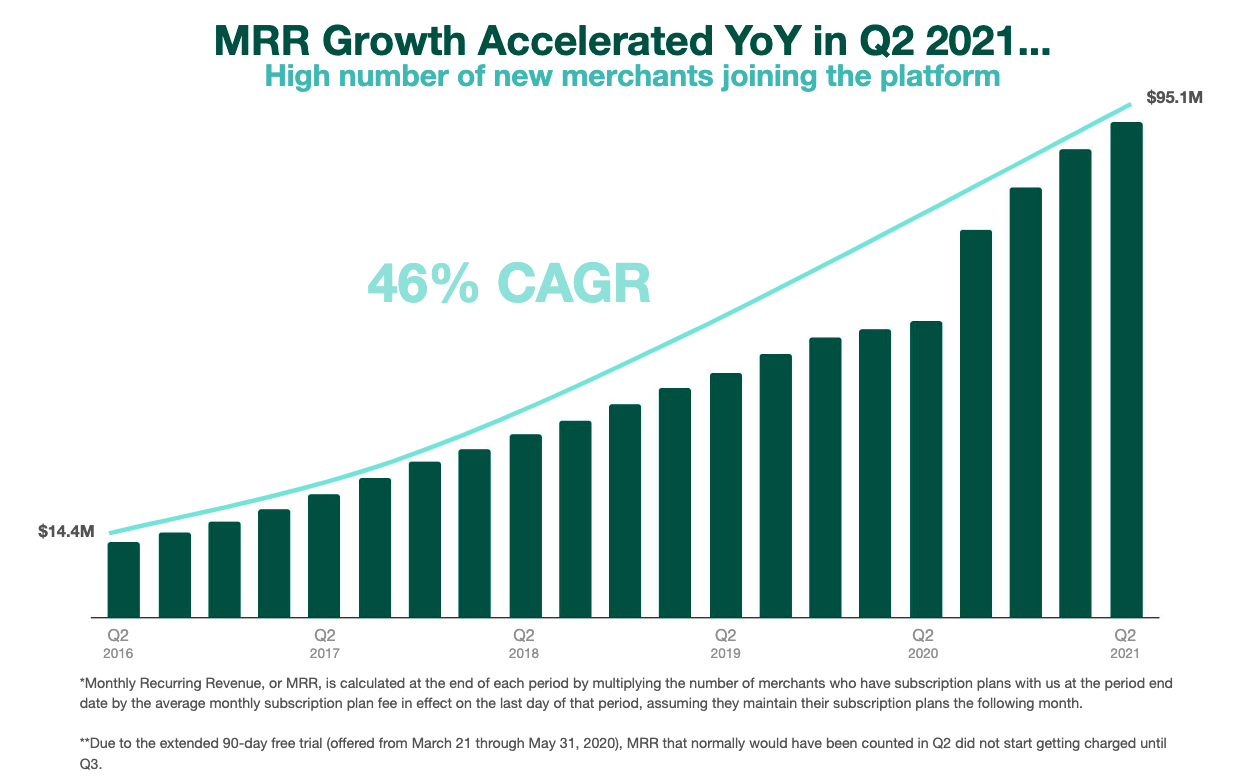

Since, 2016 Q2, MRR(Monthly Recurring Revenue) showed a huge growth of 46% CAGR. Meaning that a high number of new merchants joining the platform.

Partnership

So the question is ‘Can it beat Amazon?’, at least for now, I believe that Amazon is not a competitor of Shopify. Both companies concluded a partnership.

Shopify doesn’t have its market place which was a disadvantage but through the partnership with Amazon, started connecting its own online shop and third-party marketplace. Merchants can add Amazon as a sales channel in their stores. Also, integrated with other global marketplaces such as eBay, Wish.com and Walmart.

Also, as Facebook launched ‘Facebook Shop’, just like integrating with third-party, merchants can add Facebook Channel on their administration panel.

Concluded in-app purchasing partnership with Instagram and Pinterest. Also, the Google Pay integration was added, the release of the Google Shopping channel and strengthen cooperation in online shop advertisements.

For individual merchants’ online shops to be exposed to consumers, the consumers need to search for it because there is no marketplace at Shopify. However, these partnerships made Shopfy’s downside negligible, which was the lack of market place which can cause a lack of traffic of individual merchants’ online shops.

Source: Shopify IR

Investing Points

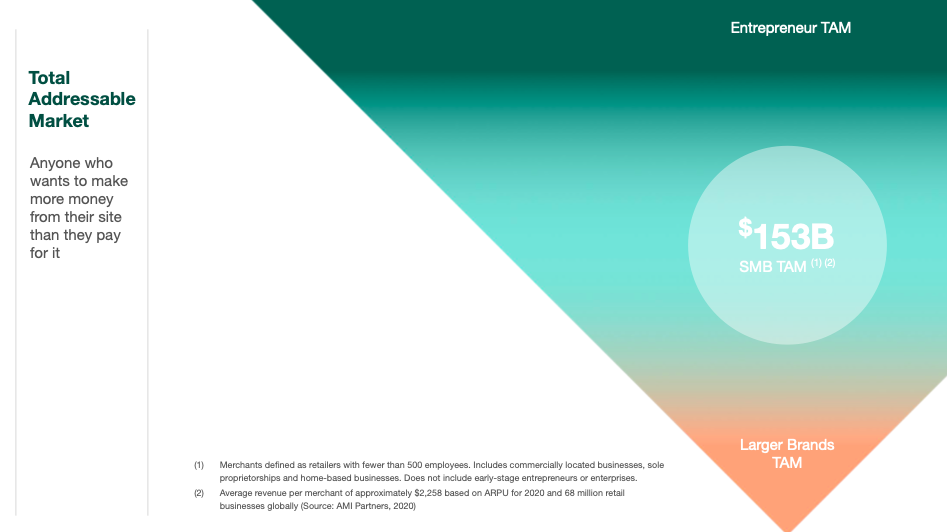

Large and Growing Market Opportunity - The retail market is one of the biggest markets in the world and e-commerce adoption is increasing significantly. I believe that even after the pandemic, the adoption of e-commerce will grow gradually because the convenience of e-commerce will hold consumers. There would be many brands that want to make their brands and the solution for them is Shopify. Therefore, the TAM(Total Addressable Market) is huge. According to AMI Partners in 2020, the TAM of SMB is 153B, which means their ARPU(Average Revenue Per User) is $2258 and 68B retail businesses globally. This doesn’t include the businesses in the early stages and major enterprises. Shopify’s 2020 revenue is 2.93billions dollars so that 2.93 x 52 = 153. Again this doesn’t include small and large businesses and as e-commerce become popular, its TAM will grow, too

As businesses using Shopify grow, the ARPU will grow, too, meaning that Shopify and its users will grow together. Also, as the market grows, more users will join the ecosystem. Therefore, Shopify is in a market that has huge potential.

The market share of Shopify in US E-Commerce in 2020 is 8.6% which is the second player.

Source: Shopify IR

Software Service - Software Service is lucrative with a high margin because once a software is developed then it is cheap to produce a copy of it. Therefore, Shopify’s gross margin is 55%. Also, the software is provided as a subscription service, the revenue is predictable and constant. Because of the profitability, many hardware companies like Apple are focusing on software revenue. Sustainable.

Ecosystem - As listed above, Shopify provides many necessary and useful solutions. I believe that once a merchant joins the ecosystem, the leaving costs will be huge, making the merchant locked in the ecosystem. This kind of ecosystem can be seen in Apple, which makes its users stay in its ecosystem and leaving it is hard. Lock-in effect.

Strong Balance Sheet - Total Liabilities to Total Assets Ratio is 0.15. This means despite it is a growing company, the risk of default is far less.

Great Business Model and Product - The trend of e-commerce is moving to DTC(Direct To Customer) however operating only a DTC channel isn’t great. Managing multi-channel such as SNS, MarketPlace, Offline Store is the most profitable. So Shopify, which has solutions that integrates multi-channel into one single platform, is becoming popular. Also, integrates all the works needed for the business, such as payments, capital, marketing, Analytics, Inventory, Shipping etc.

No Direct Competitor - Through the Partnerships, Shopify has no direct competitor.

Valuation

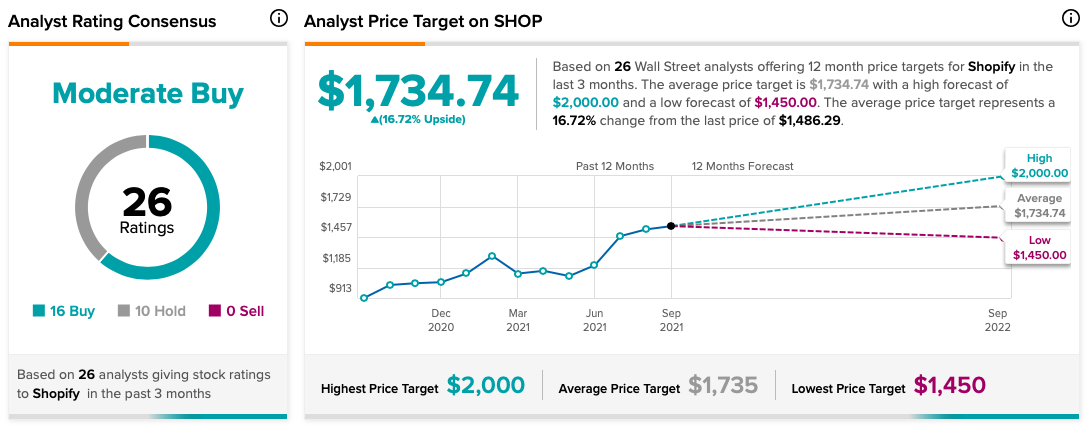

The average analyst estimate EPS this year is 6.62. The current share price is $1,486 meaning that it has a multiple of 224.5. The average Estimated growth for the next 5 years is 50%. Therefore, the PEG ratio is 4.49. The PEG of 4.49 can be considered expensive, but in my opinion, when the growth is over 50%, a PEG ratio of up to 5 is acceptable.

Considering PS Ratio, it is 48. Compared to peer groups, its short-term valuation is quite burdensome. However, it can potentially become a winner of paradigm change of retail. Therefore, instead of arguing about short-term valuation, investors need to focus on long-term growth.

PS Ratio of peer group:

Amazon: 3.96

SEA: 27.5

The average analyst target price is $1,734, which means about 16% upside.

I expect the price target of 8568 by 2030, expecting revenue of 61.2B and net income of 24.48B. Took a market share of 40% and 40% of profit margin. EPS would be 244.8 and I would give a multiple of 35. From the current price, there is about 5.76x upside.

In this regard, the current price is too high to make this stock 10-bagger. However, if its market share, margin or multiple given by the market is higher than my expectation, it might be a 10-bagger, unless I think its current price is overvalued.

Source: Tipranks

Financials

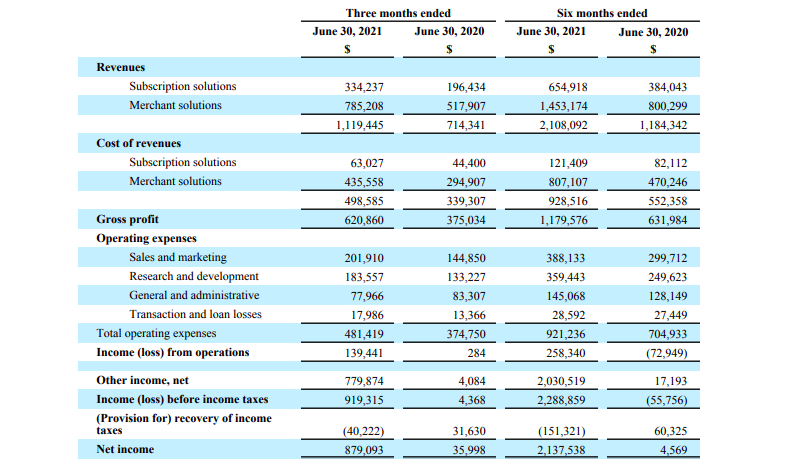

Source: Shopify IR Q2 2021

Compared to 2020, the change in revenues is exponential. As explained above, its gross margin is so high. 55% of profit margin.

However, as the company just turned into surplus(high growth), its operating expenses are big. As R&D and Sales and Marketing cost a lot. So that, operating margin is only 12%.

The interesting factor is that it has a high ‘Other Income’, mostly from unrealized investment. Therefore, I believe for Shopify, investors should focus more on gross profit.

Cash and cash equivalents are $6.3B at the end of 2020, cash on hand is huge meaning that it can be used for investment.

Total Liabilities to Total Assets Ratio is 0.15. This means despite it is a growing company, the risk of default is far less.

Risk Factors

Valuation - There is no doubt, Shopify has huge potential, there are lots of arguments about its high price. The PE ratio of both TTM and FWD is over 200. Given that the growth is 50%, the PEG ratio would be around 4. The PEG ratio of 4 when the growth is over 50%, it’s acceptable to me. However, once the growth slows down, it will lead to falling in the multiples.

Competition - There are competitors such as BigCommerce and SalesForce.

*You are reposible on your investment dicisions. I'm not an expert, the investors themselves are responsible on their dicisions and invesments.

https://kiwingitstory.tistory.com/76?category=961180

The reason why I’m investing in Alphabet(Google) / 4th industrial revolution

Of course, everyone knows Google. Search, save photos, youtube and others. We use Android unless you are a iPhone user. Google is the most famous search engine in the World. It owns Youtube which is..

kiwingitstory.tistory.com

'주식 & 경제 > 주식 분석' 카테고리의 다른 글

| 쿠팡(cpng) 주식 분석 - 흑자 전환 후 아마존의 역사를 뒤따를 주식 (5) | 2022.08.25 |

|---|---|

| 캐시우드의 ARK ETF 떨어지는 이유, 과연 거품인가? 돈나무 누나의 배신인가? (1) | 2022.05.16 |

| 애플 주식 분석 / 예상주가 / 애플 주식 투자 (0) | 2020.12.09 |

| The reason why I’m investing in Alphabet(Google) / 4th industrial revolution (0) | 2020.12.02 |

| 아마존(AMZN) 예상 주가 / 아마존 분석 / 아마존 주식 투자 / 4차 산업혁명 (0) | 2020.11.30 |